Chapter 8: Marketing the Property

Marketing Strategies

To maximize your property’s value, an effective marketing strategy is crucial. This includes:

- Professional Photography: High-quality images that highlight the property’s best features.

- Online Listings: Publish your property on popular real estate websites and social media.

- Open Houses and Virtual Tours: Allow potential buyers or tenants to see the property in person or virtually.

Sales and Rental Process

To effectively sell or rent your property, follow these steps:

- Price Evaluation: Set a competitive price based on a comparative market analysis.

- Negotiation: Be prepared to negotiate with potential buyers or tenants to reach a beneficial agreement.

- Contract and Closing: Ensure all legal documents are in order and complete the closing process efficiently.

Negotiation and Closing Operations

The final phase of the sale or rental involves negotiation and closing the deal. Ensure:

- Contract Review: Review all contracts to ensure they are fair and legal.

- Closing Coordination: Work with lawyers, agents, and other professionals to coordinate the closing effectively.

Chapter 9: Case Studies

Case Study – Investment in an Apartment in Downtown, Dubai

Project Description

- Location: Downtown, Dubai

- Property: 2-bedroom, 2-bathroom apartment

- Size: 80 m²

- Sale Price: 1,950,000 AED

- Views: Burj Khalifa

- Condition: Needs minor renovation and luxury furnishings

- Property Analysis

- Location: The apartment is located in Downtown, Dubai, one of the city’s most sought-after and dynamic areas. This area is known for its impressive skyscrapers, luxury shopping centers, and vibrant nightlife. Proximity to the Burj Khalifa, the world’s tallest building, adds significant appeal.

- Property Condition: Although the apartment’s structure is in good condition, it requires minor renovation to update the finishes to a luxury standard. It also needs complete furnishing to make it attractive to high-end buyers or luxury tenants.

- Market Analysis

- Demographics and Growth in Foreign Investment: Dubai is a cosmopolitan city with a diverse and rapidly growing population. As of 2024, Dubai has a population of approximately 3.5 million people, with a large proportion of expatriates. This growth is partly due to favorable government policies towards foreign investment, making Dubai a global hub for business and investment.

- Dubai Population: Approximately 3.5 million people in 2023.

- Population Growth: 1.5% annually.

- Median Age: 30 years.

- Cultural Diversity: Dubai is a cosmopolitan city with over 80% of the population being expatriates.

- Growth in Foreign Investment:

- Increase in Foreign Investment: In 2023, foreign direct investment in Dubai grew by 10% compared to the previous year.

- Major Investors: The largest foreign investors come from India, China, the United Kingdom, Saudi Arabia, and Germany.

- Attractive Factors: Strategic location, diversified economy, world-class infrastructure, and favorable tax policy (no personal income tax).

- Demand for Properties in Downtown:

- Downtown Dubai is a highly demanded area by both residents and foreign investors. Proximity to landmarks such as the Burj Khalifa, Dubai Mall, and Dubai Opera makes this area a coveted place to live. Recent data shows an annual increase of 5-7% in property prices in this area, with high demand for luxury rentals.

- Market Outlook:

- The real estate market in Dubai has shown signs of recovery and steady growth after the global economic slowdown. Factors such as Expo 2020 and long-term visa initiatives for investors and professionals have reinforced market confidence. Forecasts indicate that property prices in Downtown will continue to rise, supported by robust infrastructure and sustained demand.

- Financial Evaluation of the Project

Purchase Expenses

- Dubai Land Department (DLD) Fee: 4% of the purchase price

- Agency Commission: 2% of the purchase price

- Registration Fees: Approximately 5,000 AED

Estimation of Renovation and Furnishing Costs

Renovation Costs:

- Interior Renovation (luxury finishes): 1,200 AED per m²

- Total Renovation: 80 m² x 1,200 AED/m² = 96,000 AED

Furnishing Costs:

- Designer Furniture: 150,000 AED

Total Purchase and Renovation Costs

- Purchase Price: 1,950,000 AED

- DLD Fee (4%): 1,950,000 AED x 0.04 = 78,000 AED

- Agency Commission (2%): 1,950,000 AED x 0.02 = 39,000 AED

- Registration Fees: 5,000 AED

- Renovation and Furnishing Costs: 246,000 AED

Total Investment:

1,950,000AED(Purchase Price) + 78,000AED(DLD Fee) + 39,000AED(Agency Commission) + 5,000AED(Registration Fees) + 246,000AED(Renovation and Furnishing) = 2,318,000AED

Projected Income

Sale:

- Estimated Sale Price (with renovation): 2,600,000 AED

- Justification of the Estimated Sale Price: The estimated sale price is based on a comparative market analysis (CMA) using data from similar properties recently sold in Downtown Dubai with similar features (size, Burj Khalifa views, luxury finishes). Real estate platforms such as Property Finder and Bayut were consulted to obtain these data.

Rental:

- Estimated Monthly Rent: 15,000 AED

- Justification of the Estimated Monthly Rent: The estimated monthly rent was obtained by consulting short-term and long-term rental platforms such as AirDNA and Property Finder, which provide data on current rental rates for similar apartments in Downtown Dubai. Current rental rates for 2-bedroom apartments with luxury finishes and Burj Khalifa views range between 14,000 and 16,000 AED per month.

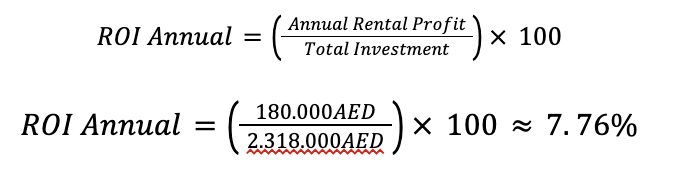

- Annual Rental Income: 15,000 AED x 12 = 180,000 AED

Calculation of Return on Investment (ROI)

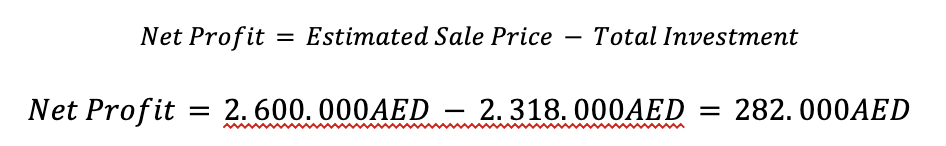

Net Profit (Sale):

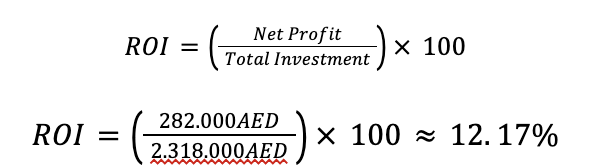

ROI (Sale):

ROI (Rental):

This case study shows the evaluation of an apartment in Downtown Dubai with different strategies: rental or sale (flipping). Here we evaluate the project’s viability based on the calculated Return on Investment (ROI) for both strategies.

ROI for Sale (Flipping)

- Evaluation: With an ROI of 12.17%, this project does not meet the viability criterion for flipping. Therefore, it is not recommended to develop this project with the intention of selling it immediately after renovation.

ROI for Rental

- Viability Criterion: To consider a rental project viable, the ROI should be greater than 9% annually.

- Evaluation: With an ROI of 7.76%, this project does not meet our viability criterion for rental. Therefore, it is not recommended to develop this project with the intention of renting it out.

Final Conclusion

Since the project does not meet the established viability criteria for either strategy (sale with an ROI above 20% and rental with an ROI above 9%), it is not considered viable. Therefore, it is recommended not to proceed with the purchase and renovation of this apartment in Downtown Dubai, as it does not offer the expected return on investment according to our standards.

ABOUT ELEVEX

EleveX is a Decentralized Exchange (DEX) for tokenized real estate projects and markets, offering a comprehensive platform that includes a launchpad for new project launches, an exchange for secondary market trading, perpetuals for leverage trading on geographical real estate indexes, and a dashboard for asset management. With EleveX, real estate ownership becomes accessible and affordable, providing users with seamless access to lucrative projects and innovative trading opportunities.

Official Links: https://linktr.ee/elevexai