We often receive the question: Is it still a good time to invest in Spanish real estate? To provide a comprehensive answer, let’s delve into the current state of Spain’s property market, examining supply and demand dynamics, recent policy changes affecting foreign investors, and identifying potential investment opportunities.

CURRENT SITUATION

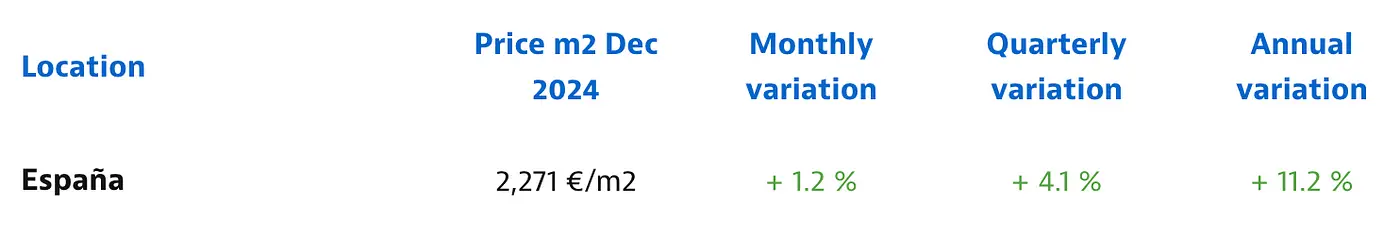

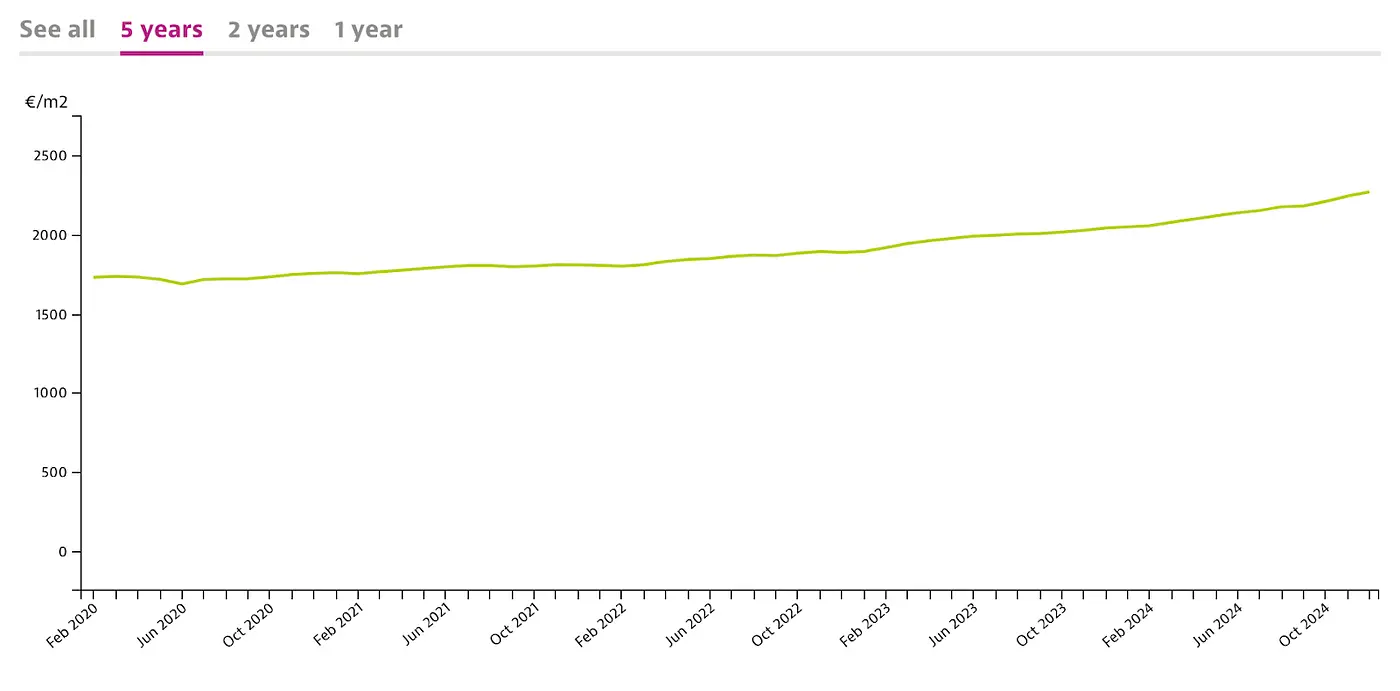

Spain’s real estate market has long been a magnet for international investors, thanks to its pleasant climate, rich culture, and attractive property prices. Over the past three years, the market has seen an average appreciation of 7.9% per year, with property values increasing by 7.4% in 2022, 5.3% in 2023, and 11.2% in 2024. This steady growth highlights the resilience of Spanish real estate, making it an appealing option for both local and international investors.

However, recent developments have introduced new variables that could influence investment decisions. Government policies, short-term rental restrictions, and proposed tax increases are reshaping the landscape, requiring investors to be more strategic in their approach. In this analysis, we’ll break down the current market dynamics, the challenges and opportunities they present, and the best investment strategies moving forward.

CHALLENGES IN THE MARKET

-

- Supply and Demand Imbalance

The Spanish housing market is currently experiencing a significant imbalance between supply and demand. A recent report highlighted that the availability of properties is scarce compared to the high demand, leading to elevated prices and intense competition among buyers. For instance, in Madrid, it’s not uncommon for a newly listed apartment to receive multiple offers within minutes.

- Supply and Demand Imbalance

-

- Policy Changes Impacting Foreign Investors

The Spanish government has proposed several measures aimed at addressing housing affordability:

- Policy Changes Impacting Foreign Investors

-

- 100% Tax on Non-EU Buyers: Prime Minister Pedro Sánchez has announced plans to impose a 100% tax on property purchases by non-EU residents. This move is intended to curb speculative investments and prioritize housing access for residents.

-

- Termination of the Golden Visa Program: Effective April 3, 2025, Spain will end its Golden Visa program, which previously granted residency to non-EU citizens investing at least €500,000 in real estate. This change could deter foreign investors seeking residency through property investment.

3. Restrictions on Short-Term Rentals

In cities like Málaga, Valencia, and Alicante, local authorities are implementing measures to regulate short-term rentals to address housing affordability and availability for local residents:

-

- Málaga: The city has restricted the issuance of new licenses for tourist accommodations in 43 neighborhoods, including popular areas like the Historic Center, La Merced, and La Malagueta. This measure aims to control the proliferation of short-term rentals and their impact on housing availability.

4. Valencia: The local government has approved a new ordinance limiting tourist apartments to 2% per neighborhood. Notably, entire buildings can still be dedicated to tourist use, and new hotel constructions are capped at 8% per neighborhood. In areas where tourist accommodations exceed 8% relative to the number of registered residents, no new tourist places will be permitted.

5. Alicante: A moratorium has been announced, suspending the processing and granting of licenses for new tourist apartments for up to two years. This suspension applies citywide and includes any changes of use to establish new tourist accommodations.

IMPLICATIONS OF THESE CHALLENGES

These policy shifts are designed to make housing more accessible to Spanish residents. However, they also introduce uncertainties for foreign investors, particularly those from non-EU countries. The proposed tax increases and the end of the Golden Visa program may lead to a decrease in foreign investment, potentially affecting property values in areas previously popular among international buyers.

OPPORTUNITIES AND STRATEGIC CONSIDERATIONS

Despite regulatory challenges and rising property prices, Spain remains a highly attractive real estate market for those who know where and how to invest. While some strategies that worked in the past may no longer be as effective, such as traditional short-term rentals in overregulated areas, there are still several strong investment approaches that can generate high returns.

- Alternative Investment Strategies in Major Cities

Here are some viable strategies for investing in these prime locations:

- Property Development: With rising property prices in city centers like Madrid or Barcelona, investing in new developments or large-scale renovations in expanding peripheral areas is a smart alternative. These zones offer lower costs, strong demand, and long-term growth potential due to improved infrastructure and urban expansion.

-

- Below-Market Purchases for Renovation and Resale:

One of the most time-tested and profitable strategies in real estate is buying properties below market value, renovating them to add significant value, and reselling at a higher price — better known as “flipping.” This approach remains highly effective in Spain, particularly in high-demand urban areas where modern, well-renovated properties are scarce and highly sought after.

- Below-Market Purchases for Renovation and Resale:

-

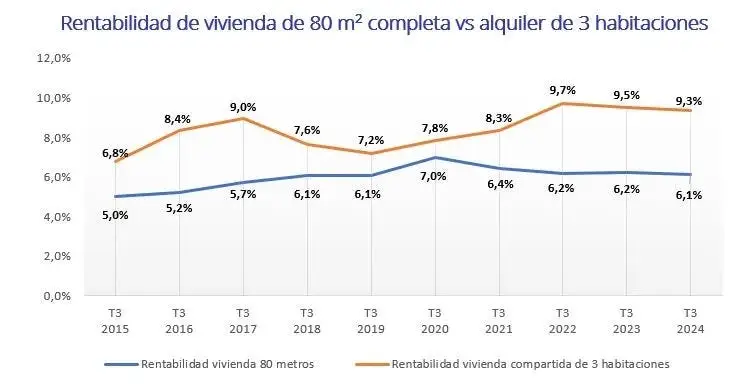

- Room Rentals: Purchasing properties near universities or business districts and renting them by the room can yield higher returns due to consistent demand from students and professionals. According to a study by Fotocasa, renting out a property by individual rooms offers an average profitability of 9.3%, compared to 6.1% for renting the entire property, a difference of 3.2 percentage points.

- Investing in Tourist Rentals in Permissive Cities

-

- For those interested in short-term rental investments, focusing on cities with favorable regulations and high tourist demand is advisable. Examples include:

Tenerife (Canary Islands): As a year-round tourist hotspot, Tenerife boasts a pleasant climate and numerous attractions. The island currently has more lenient regulations regarding tourist accommodations, making it an attractive option for investors.

Seville: With its vibrant culture and landmarks like the Seville Cathedral, the city offers strong demand for short-term rentals and a regulatory environment that remains accommodating to investors.

Cádiz: Coastal charm and historical significance make Cádiz an attractive destination. The city has not implemented stringent restrictions on tourist rentals, presenting opportunities for investors.

Additional Summer Tourist Destinations:

Costa del Sol: Encompassing towns like Marbella and Fuengirola, this region is renowned for its beaches and upscale resorts. While some areas have introduced regulations, opportunities still exist, especially in municipalities with more lenient policies.

Costa Blanca: Including cities like Torrevieja and Denia, this coastline attracts numerous summer visitors. Certain towns have fewer restrictions on short-term rentals, making them appealing for investment.

Balearic Islands: Islands such as Menorca and Formentera, though smaller, have high tourist demand during the summer months. Investors should research local regulations, as policies can vary between islands.

CONCLUSION

Investing in Spanish real estate in 2025 requires careful navigation of new policies and market dynamics. While challenges exist, strategic investments in alternative strategies within major cities or focusing on tourist rentals in permissive locales can still yield favorable returns. As always, thorough due diligence and consultation with local real estate experts are essential to making informed decisions.

At Elevex, we closely analyze the market and we consider that Spain still holds great potential, if you stay ahead of market trends and navigate the evolving landscape wisely.

We’re actively monitoring the best investment opportunities, and soon, we’ll share more details on how Elevex can help you capitalize on them. Stay tuned!